How to Increase Insurance Agent Productivity in 5 Simple Steps

Work smarter, close faster: your path to peak productivity.

Hannah Ouijdani

Ready to book more meetings?

Insurance agents juggle a lot—client acquisition, scheduling meetings, follow-ups, and all the admin work. Sound familiar? We get it!

Balancing all these tasks can feel overwhelming, but with a few smart strategies and the right tools, you can streamline your day and make it work for you.

Ready to learn how to boost insurance agent productivity? Let’s dive in!

How do I become a productive insurance agent?

Productivity isn't about squeezing more into your already-packed day—it’s about working smarter.

So let’s talk productivity tips! Here are some of our favorites:

- Take breaks: When you feel stuck, step away from your desk. Sometimes, a quick walk or just 10 minutes of stretching can help you reset.

- Block focus time: Use your calendar to schedule time for deep work—no distractions, no interruptions. Make sure to mark it as “busy” so no one sneaks a meeting in.

- Automate repetitive tasks: Save time by automating the small stuff—like scheduling meetings, sending reminders, or even follow-up emails. Using tools like YouCanBookMe can take these tasks off your plate so you can focus on more important work.

- Leverage productivity methods: The Pomodoro technique is a classic—work in 25-minute focused bursts, followed by short breaks. This helps maintain energy and focus throughout the day.

And speaking of productivity methods, let’s check out two more simple strategies that can make a big difference in how you tackle your day.

What is the 1-3-5 rule of productivity?

Ever felt paralyzed by the sheer number of tasks you have to do? The 1-3-5 rule helps you get moving and manage your day by focusing on:

- 1 big task

- 3 medium tasks

- 5 small tasks

It’s perfect for knocking out those smaller, everyday to-dos while still making progress on bigger projects. It takes that neverending list of things you have to get done and breaks it down into smaller, easily digestible chunks. Helpful, right?

What is the 3 by 3 rule for productivity?

If you have trouble prioritizing your day, you might want to try the 3 by 3 rule.

The idea is to finish 3 key tasks by 3 p.m. so you’re focusing on your top priorities while your energy levels are still high. That way, you’re hitting the important stuff first and saving smaller, less urgent tasks for later in the day.

Both of these methods are great for managing time and getting more done without feeling overwhelmed.

5 Strategies to maximize insurance agent productivity

Now that you’ve got a few general productivity methods in your back pocket, let’s look at how you can take it to the next level as an insurance agent. Boosting productivity isn’t just about getting through tasks—it’s about working smarter to drive more business and keep your calendar full.

Here are five strategies to help you do just that.

1. Drive more business (so that your calendar’s always full)

A full calendar = a thriving business. One key step is learning how to increase insurance sales effectively.

By combining smart marketing strategies, automating your scheduling process, and qualifying leads early on, you can bring in more clients who are ready to buy—without wasting time!

Here are some of our favorite strategies for keeping you booked and busy.

Marketing strategies

A smart marketing strategy is like your secret weapon—it helps you get in front of the right people, so your calendar fills up with clients who are ready to chat. Less chasing, more booking:

- Boost your online visibility: Think of SEO as your GPS—helping clients find you faster! By optimizing your website and content, you’ll pop up in search results like the star you are. Sprinkle in some content marketing (blogs, videos, the works), and you’ll shine even brighter. An AI video generator can be a game-changer, making your video content more dynamic and easier to produce.

- Get social: Your potential clients are hanging out on social media, and that’s where you should be too! Engage with your audience, share your insights, and don’t be afraid to get a little creative.

- Email magic: Want a surefire way to keep leads warm? Email! Follow up with personalized messages to remind them of your services, nudge them to book, or simply say hello.

Still need more ideas? Don’t worry; we’ve got you covered with our guide on how to get clients.

Make it easier to book with you

If your clients have to jump through hoops to book a meeting, guess what? They might not book at all.

Make it super simple by sharing your booking link everywhere—your website, email signature, social profiles—you name it.

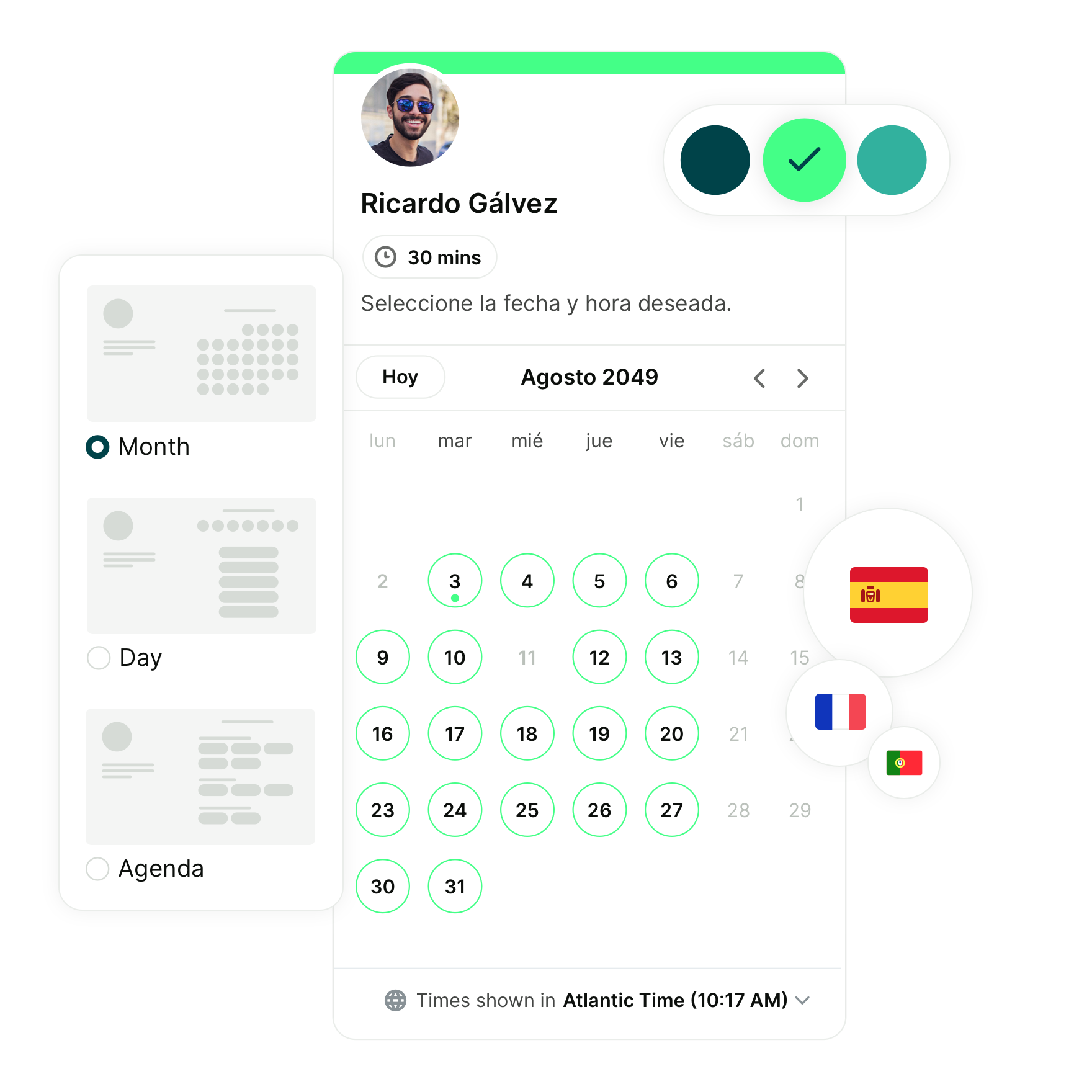

With scheduling software for insurance agents like YouCanBookMe, your clients can easily schedule a time that works for them, and you can:

- Automate reminders: Send email or SMS reminders so no one forgets their appointment.

- Let clients book instantly: Clients can secure a meeting right when their interest is highest without waiting for you to respond! Speed to lead matters—the faster a client can book with you, the more likely you are to convert them.

- Stay organized: All your bookings sync to your calendar, so you never have to worry about double-booking or missing an appointment. Plus, you can integrate YouCanBookMe with 6,000+ apps (including handy tools like HubSpot’s CRM) to ensure you’re not wasting time inputting the same information into multiple tools.

2. Bring in the right people

Sure, getting clients is great, but getting the right clients is even better.

You know how it goes—some prospects are a perfect fit, while others? Not so much.

The trick to growing your business efficiently is spending your time where it matters most: with clients who are ready to convert and are likely to stick around.

Lead qualification

How do you know if a prospect is a good fit? That’s where lead qualification comes in.

By asking the right questions upfront, you’ll be able to figure out if a potential client is serious about your services and has needs you can meet.

This process saves you time, energy, and ensures that you’re working with clients who are in it for the long haul.

Here are a few lead qualification questions to ask:

- What’s your current insurance coverage?

Asking this helps you get a sense of where they’re at and whether they might need more or different coverage. It’s an easy way to see if they could be a good fit for what you offer. - What challenges are you facing with your current provider?

Understanding their pain points allows you to assess if your services are the right solution to address those problems. - What are your coverage goals?

By understanding what they want in the long run, you can see if potential leads are serious about finding the right fit, which helps you decide if it’s worth moving forward with them!

For more tips, check out our detailed lead qualification guide.

|

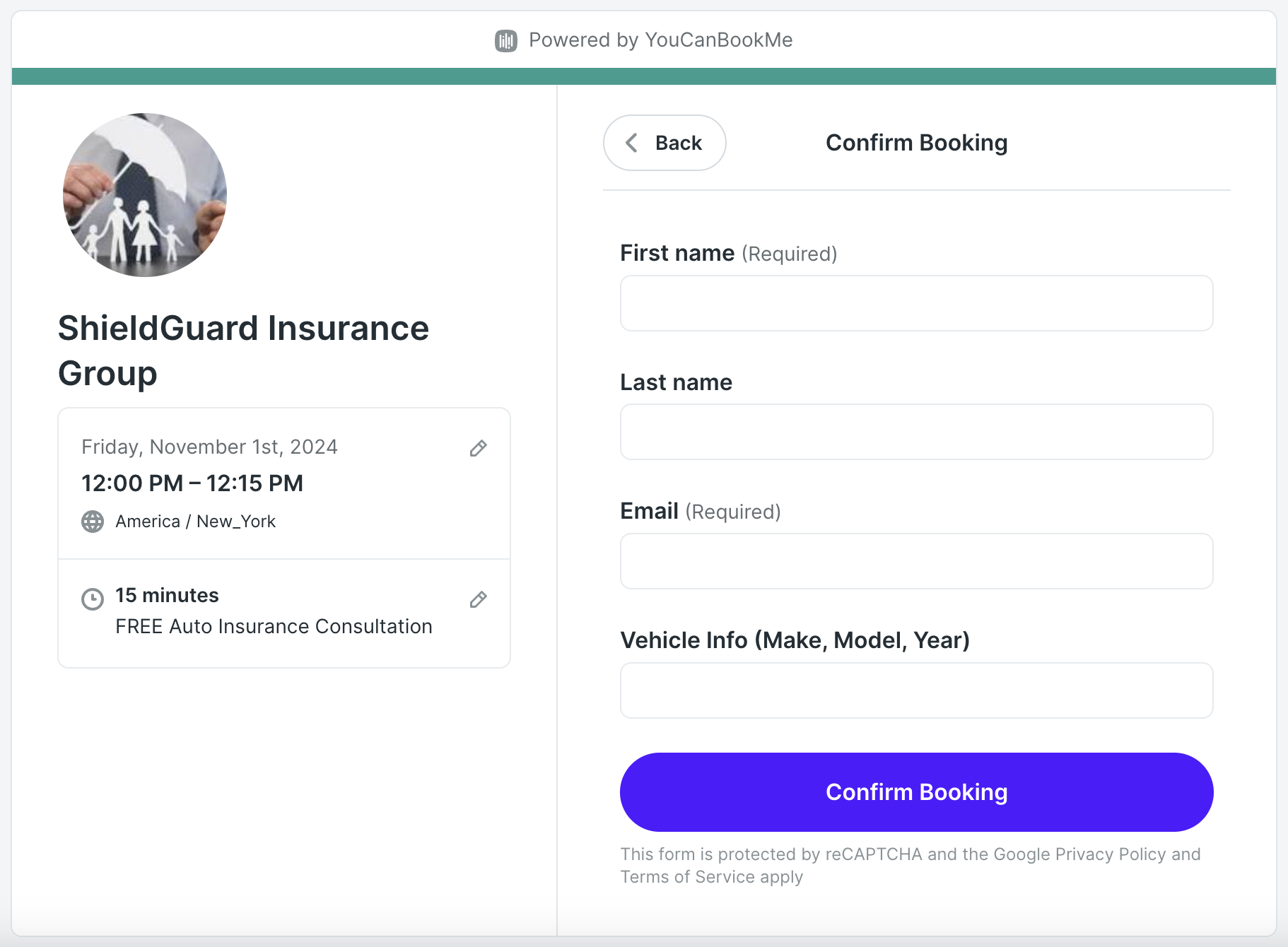

💡 Pro Tip: Use lead qualification questions to pre-screen clients right in your booking form. It’s an easy way to weed out unqualified leads and focus on those who are ready to take action. |

3. Leverage the right tools and automate repetitive work

We get it—you’re busy! Managing a full client roster and a packed calendar can feel like a never-ending game of Tetris. That’s where automation comes in to save the day.

Why manually input customer data, manage projects, or handle scheduling, when your tools can do it for you?

Let’s dive into how to increase insurance agent productivity with these must-have apps. 👇

CRM systems

Stay organized and never miss a beat with a CRM system like HubSpot or Salesforce, or an AI CRM system like Creatio. These tools track client interactions, follow-ups, and sales opportunities, ensuring nothing falls through the cracks.

Automating your client management saves time and helps you focus on what matters most—building relationships and closing deals.

Project management tools

Keep your projects and tasks in order with project management tools like Asana or Trello. You can assign tasks, set deadlines, and track progress to ensure that everything gets done on time—without the chaos. These tools help you manage your workload and keep your team aligned, all while reducing stress.

|

📢 Pro Tip: For seamless insurance agency optimization, YouCanBookMe integrates smoothly with your favorite tools—whether it’s your CRM, project management software, or calendar—ensuring your business runs like a well-oiled machine. 🚀 |

Scheduling software that works for you

YouCanBookMe is like having a personal assistant (minus the coffee runs). It’s designed to automate the parts of scheduling that usually bog you down.

Want to impress your clients and save yourself from endless back-and-forth emails? Here’s how YouCanBookMe helps you do just that:

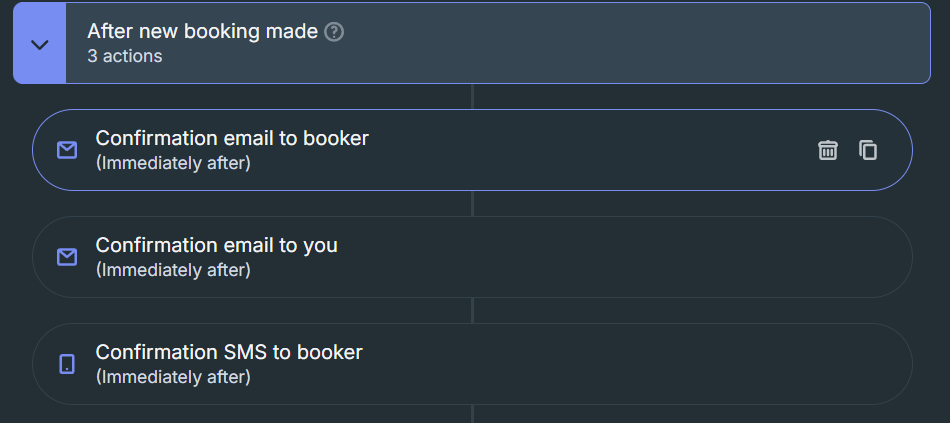

- Auto-magic confirmations and reminders: The moment a client books, they get an instant confirmation, followed by automated reminders leading up to the meeting. No more worrying if someone’s going to ghost you—YouCanBookMe has your back.

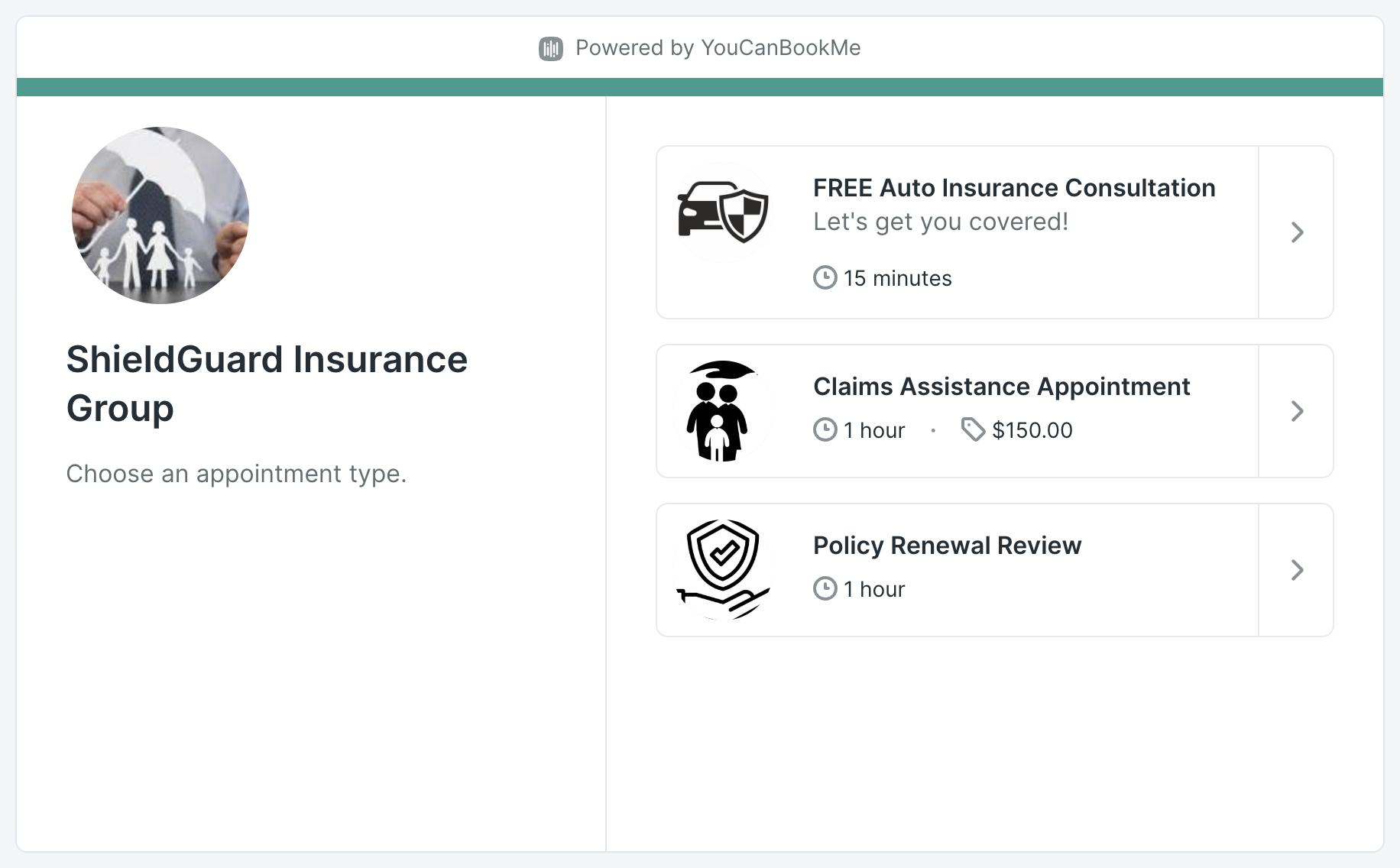

- Custom booking pages that shine: Need different types of meetings? Create booking pages that reflect your brand and give clients a smooth, tailored experience. Whether it’s a quick consult, a discovery call, or an in-depth meeting, they can pick what they need with zero hassle.

- Up-to-date availability: YouCanBookMe syncs in real-time with your calendar, so clients can only book slots that are truly open. No double-booking disasters here!

- Collect important info right at booking: Know who is booking you and why ahead of time so you can show up to each meeting fully prepped and ready.

Ready to let your calendar work for you? See how YouCanBookMe can streamline your scheduling.

✨Bonus ✨Pro tips for automating your sales meeting scheduling

Want to make your scheduling even easier? Let’s talk power moves with these simple tips that take your automation game to the next level:

- Booking pages for every occasion: You don’t wear the same outfit to every event, right? Your booking pages shouldn’t be one-size-fits-all either. Customize your pages for different types of meetings, so clients know exactly what to expect.

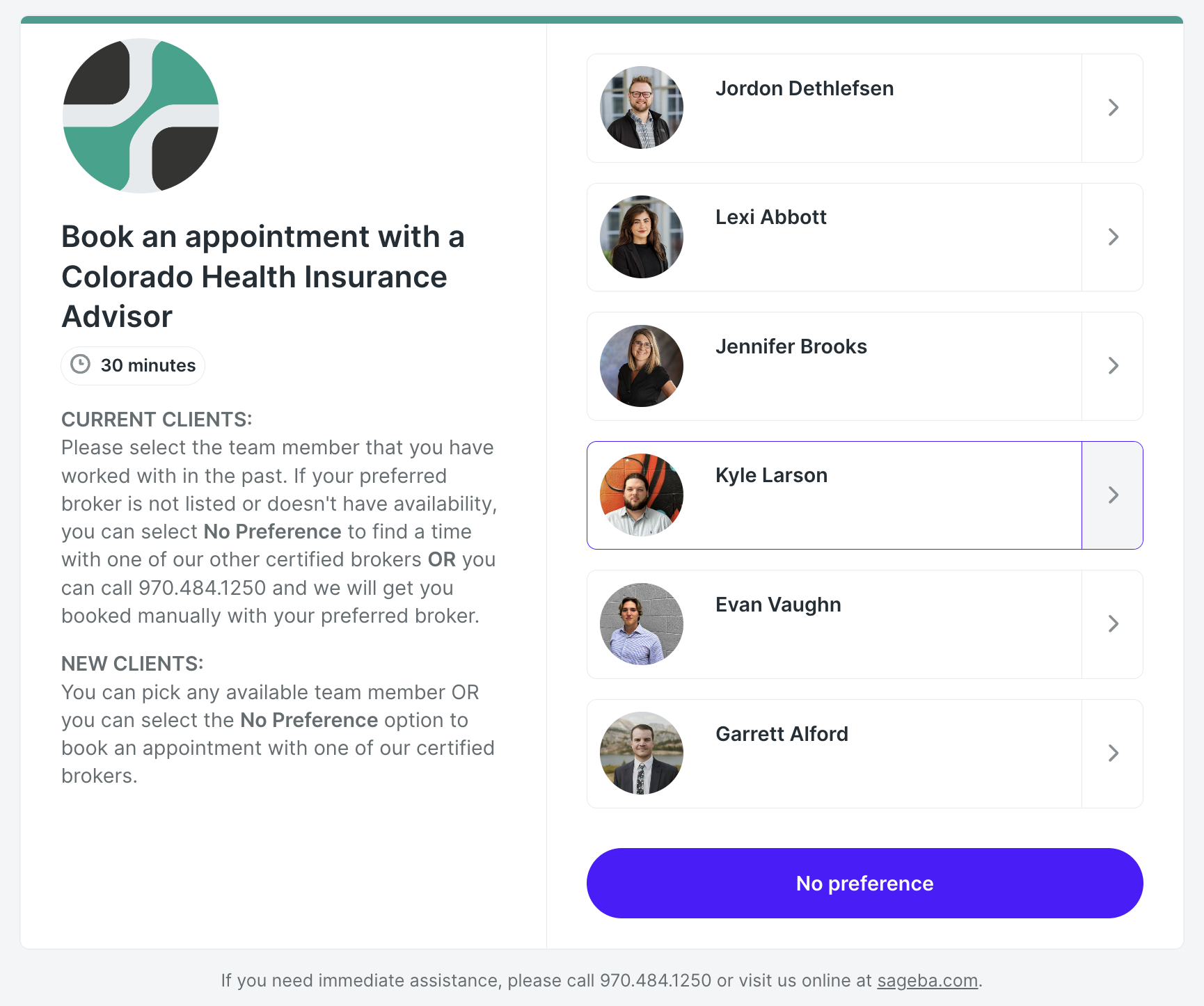

👉 A real example from a real client

- Sync your calendars: Make sure your scheduling tool is synced with your main calendar (Google, Microsoft, etc.). This ensures real-time availability, preventing double bookings and keeping your schedule accurate.

- Use buffer times: Avoid the stress of back-to-back meetings by adding buffer times between appointments. A 15-minute break lets you prepare for the next call or finish tasks from the previous one. Tools like YouCanBookMe make this easy to configure.

- Set working hours: Define specific hours when you're available for meetings. Setting working hours is another simple step in how to increase insurance agent productivity while maintaining a healthy work-life balance.

- Automate reminders: Automatically send confirmation emails and reminder messages to clients before their scheduled meeting. This reduces no-shows and keeps everything running smoothly. YouCanBookMe handles this automatically once set up.

- Use round-robin scheduling for teams: If you’re part of a sales team, round-robin scheduling can automatically assign meetings to the next available team member. This distributes the meeting load evenly and ensures clients are connected to the right person at the right time.

4. Embrace a culture of learning

The best insurance agents? They’re always learning! 🌱

In a fast-moving industry like insurance, staying sharp and up-to-date is key. Whether it's brushing up on industry trends, grabbing new certifications, or tuning into webinars—commit to growth, and you’ll stay ahead of the game.

- Stay updated on industry trends: Insurance changes all the time—new regulations, shifting client needs. Keep an eye on the latest updates by following industry news or subscribing to a few go-to blogs. It not only boosts your know-how but also helps build trust with your clients (they love an agent who’s always in the know!).

- Get certified: Want to level up? Certifications are a great way to sharpen your skills and boost your credibility. Whether it’s in risk management or financial planning, extra qualifications can set you apart and show clients you're serious about their needs.

- Tune into webinars and online courses: There are so many learning opportunities right at your fingertips! From free webinars to full online courses, you can keep growing without ever leaving your desk. Find hands-on tips you can put into practice ASAP.

- Mentorship and networking: Surrounding yourself with a strong professional network can be invaluable. Learning from seasoned mentors or engaging in discussions with peers at events or through online communities will provide insights that can shape your career. Even informal discussions with fellow agents can spark ideas and offer new perspectives.

- Leverage AI tools: Tools like ChatGPT can be a game-changer for your business. Need fresh ideas for a marketing campaign? Use AI for brainstorming. Trying to streamline client communications? ChatGPT can help craft email templates, create responses to client queries, or even assist in drafting marketing copy.

|

💡 Pro Tip: If you’re a leader looking for ways to increase agent productivity, block out a little "learning time" every week. Even an hour spent reading up on trends or watching a webinar can make a huge difference in how you serve your clients. |

5. Optimize client meetings

Meetings don’t have to be a time-suck! They’re crucial for building relationships and closing deals, but without a plan, they can drain your productivity fast.

One way to avoid this is by using custom booking forms. These let you gather key details ahead of time, so you’re ready to tailor each meeting to your client’s needs and hit the ground running.

Let’s turn those meetings into your secret weapon by making them smooth, focused, and action-packed.

Here are a few more tips to help you maximize the value of your meetings:

Make scheduling quick and simple

YouCanBookMe makes scheduling meetings a breeze for you and your clients—just share your booking link and let them pick a time that works. No more back-and-forth emails clogging up your inbox or wasting precious time.

It’s quick, seamless, and keeps you in control of your schedule, ensuring your days run smoothly without any unnecessary hassle.

Set meeting objectives

Successful meetings start with clear goals. Send out meeting agendas ahead of time so everyone comes prepared.

When you define the objectives early, you ensure the conversation stays on track and doesn’t meander into unrelated topics. Your clients will appreciate the clarity, and you’ll get more done in less time.

Clear objectives equal a more productive meeting.

Follow up effectively

Once the meeting’s over, it’s time to keep the ball rolling. well-crafted follow-up email recaps the key points discussed, outlines next steps, and ensures everyone is on the same page.

Not only does this show your clients that you’re organized and proactive, but it also helps you stay on top of each opportunity.

Need help getting started? We’ve got handy meeting follow-up email templates and a guide detailing how to improve meeting productivity.

Your path to next-level productivity

Whether it’s using custom booking pages, automating reminders, or applying productivity hacks like the Pomodoro technique, these small adjustments can significantly improve agent productivity without overwhelming your day.

Ready to take your productivity to the next level? YouCanBookMe has the tools to help you increase your efficiency, book more clients, and grow your business. Let’s get your schedule working for you! Try YouCanBookMe today and see the difference.

FAQ

What is the productivity of an agent?

The productivity of an insurance agent can be measured by how effectively they manage their time and workload. A productive agent efficiently handles client meetings, follows up with leads, and closes sales—all while keeping admin tasks to a minimum. Automating repetitive work (like scheduling and reminders), focusing on high-priority tasks, and maintaining a steady stream of new business opportunities are key markers of productivity.

How to increase revenue in insurance?

Increasing revenue in insurance is all about working smarter. Focus on upselling and cross-selling—offer clients additional coverage that complements their current policies. Another key strategy? Follow-ups—clients who need more time to make decisions are still leads! Automating your follow-up process ensures nothing slips through the cracks. Plus, generating more leads through targeted marketing and strong referral programs can keep your pipeline full.

Why do so many insurance agents fail?

Insurance agents often fail because they get bogged down in administrative tasks, struggle to keep up with leads, or miss out on crucial follow-ups. Without the right tools and processes, managing time effectively becomes a major challenge. Success as an agent requires not just selling, but staying organized, automating where possible, and focusing on building relationships. Many agents also neglect continuous learning, missing out on new industry trends and techniques that can boost their competitiveness.

Subscribe to our newsletter

Get productivity tips, news, articles and resources.

Written by

Hannah Ouijdani

Hannah never planned to be a content writer, but it’s her favorite happy accident. What started as a passion for all things celestial turned into a popular astrology Twitter account, and soon she was ghostwriting horoscopes, newsletters, and articles for magazines, brands, and even musicians. She’s been Head of Copy at a creative agency, where her love for space and science fiction naturally pulled her into the worlds of SaaS, AI, and the coolest tech. Now, she dreams of being the first writer to advertise on Mars.